CSE: SCM

| Expl Target Range | Tonnes (MT) | %Zn | %Pb | %Cu | g/t Au | g/t Ag |

|---|---|---|---|---|---|---|

| Low | 4.5 | 2.8 | 2.3 | 2.2 | 0.3 | 120 |

| High | 9.0 | 1.4 | 1.2 | 1.1 | 0.15 | 60 |

| Vein | Estimated Tonnage (Mt) | Zn (%) | Pb (%) | Cu (%) | Ag (g/t) | Au (g/t) |

|---|---|---|---|---|---|---|

| Vein I | 3.2 | 2.1 | 1.8 | 1.5 | 250 | 1.2 |

| Vein II | 1.1 | 1.9 | 1.6 | 2.1 | 180 | 3.5 |

| Vein IV | 0.8 | 2.3 | 1.7 | 2.0 | 300 | 2.8 |

| Vein V–VI | 1.5 | 2.0 | 1.5 | 1.2 | 200 | 1.0 |

| Total | 6.62 Mt | – | – | – | – | – |

| Structure | Direction | Estimations |

|---|---|---|

| Filon I | E-W | 2 995 200 t |

| Filon I | NE-SW | 600 000 t |

| Filon II | NW-SE | 195 000 t |

| Filon II bis partie Ouest | E-W | 416 000 t |

| Filon II bis partie Est | E-W | 210 600 t |

| Filon III | E-W | 234 000 t |

| Filon III bis | E-W | 48 360 t |

| Filon IV | N-S | 1 946 880 t |

| Remblais | - | 16 450 t |

| Total | 6 662 490 t | |

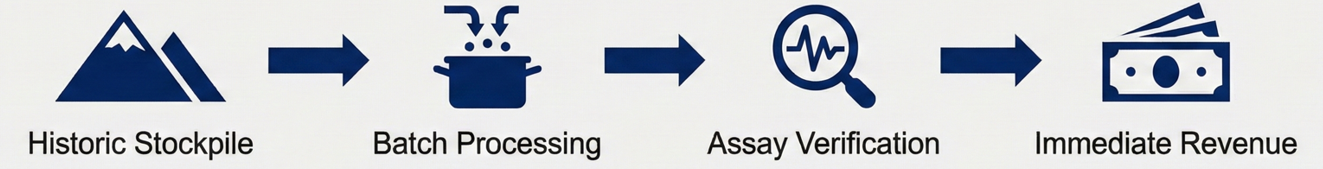

Contract Signed: Binding agreement with MoResCo Sarl to process and sell historic Goundafa mineralized stockpiles, starting with 14,400 tonnes to be sold.

Contract Signed: Binding agreement with MoResCo Sarl to process and sell historic Goundafa mineralized stockpiles, starting with 14,400 tonnes to be sold.